Ondrej Markus

Entrepreneur in ed-tech, building the future of education as a founder and CEO at Playful.

I write about the future of education, designing learning games, and running a startup.

I'm a generalist, introvert, gamer, and optimizing to be useful.

Fund yourself

Money is a versatile resource. We can trade it for almost anything at any time. It creates options, flexibility, and safety. And that’s why we like it.

But because money represents so many things we want, it’s easy to mistake it for the goal, while it’s just a resource. And it would be pointless to hoard a resource we never use for what it’s for.

So what is money for?

Money should make you happier

I’ve thought about this a lot, and I think it’s okay to simplify and say that we all want to feel good. We want to be happy, whatever that means to you or me at different moments.

Happiness has many forms. I like this phrase: “Peace is happiness at rest. Joy is happiness in motion." I think it describes the happiness landscape nicely.

But, the point is, whatever state you’re seeking, you can probably agree that you want to feel good in life. And that the purpose of money is to help you get there and stay there.

Although, having a dysfunctional mindset, methods, and tools to manage money in your life can badly hurt your happiness. And it doesn’t matter if you have a lot of it, none of it, or just enough of it.

Happiness is a state of mind you develop and maintain with what you’re doing. And money can help you or hurt you in achieving that.

So the question is: How to approach money in a way that helps us be happier, instead of hurting us?

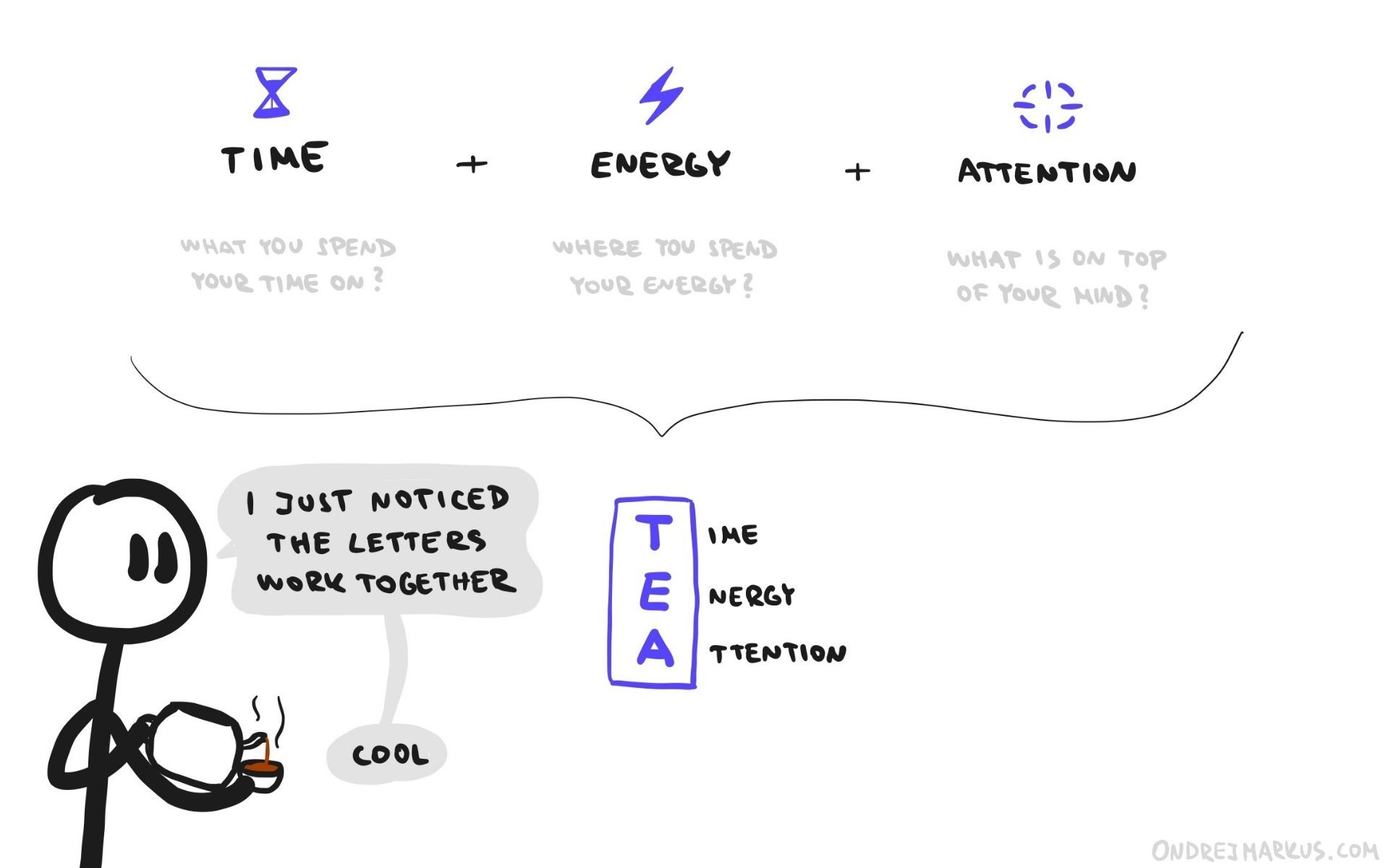

Protect your tea

Time, energy, and attention (TEA) are resources that form your state of mind. They are what you do, what you think, and what you feel.

You can suffer no matter how luxurious your surroundings are if your attention is in a bad place.

At the same time, your external conditions might be irrelevant if your attention is on things that make you happy.

Where your time goes, energy flows, and attention grows.

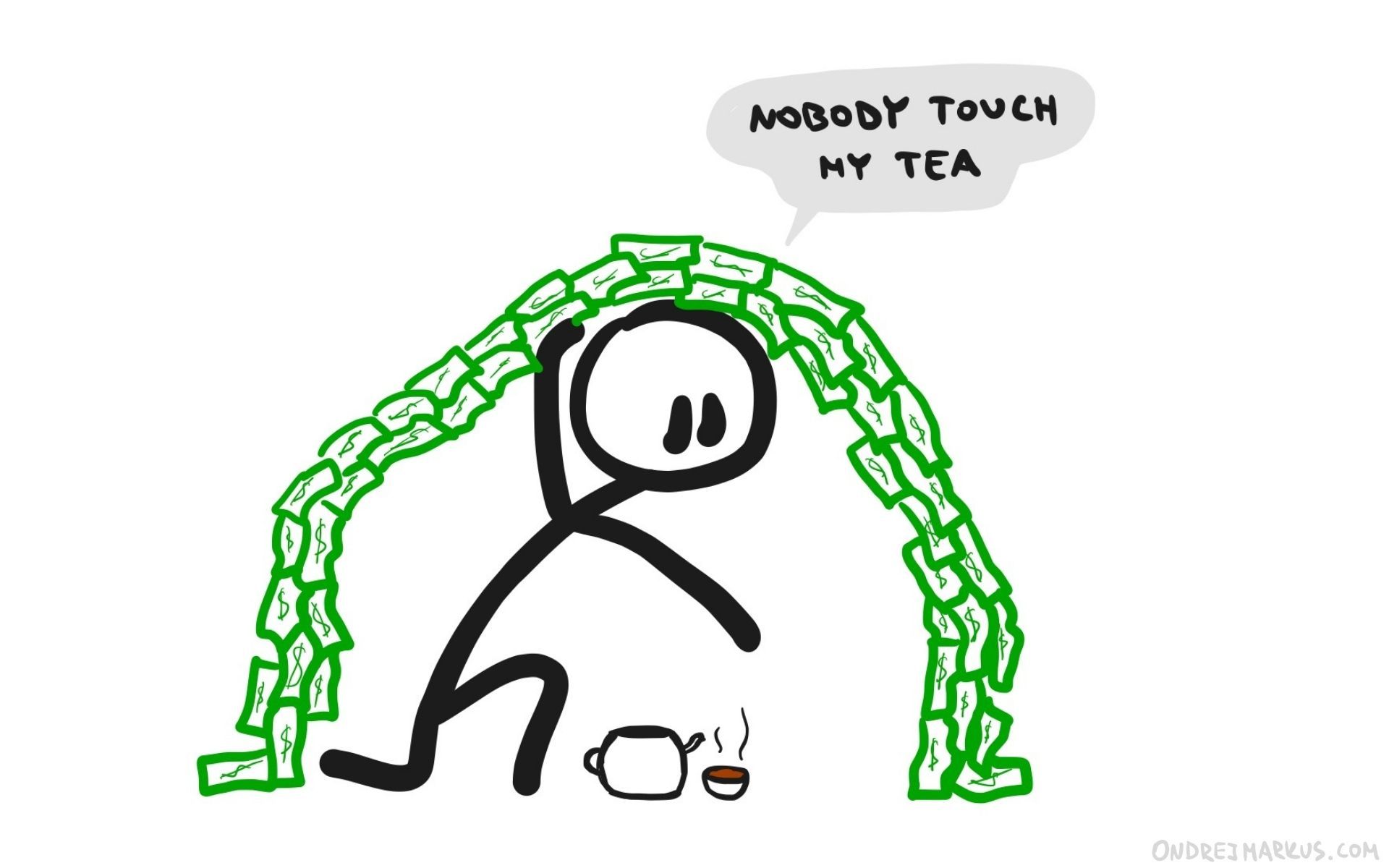

Protecting your time, energy, and attention is the core of the idea to Fund yourself. It means to put yourself first when you’re deciding how to use money.

Use money to optimize your TEA instead of using your TEA to optimize for money.

This is crucial. Because where your TEA goes defines your state of mind. If you suppress your TEA in order to make more money, you will probably be miserable.

The base of a good life is that your TEA is free to focus on things you genuinely care about. Once it does, you will thrive, and, funnily enough, money will most likely follow as a byproduct of your TEA going in the right places anyway.

How to use money to fund yourself

I’m not saying, “quit your job tomorrow and go on that expensive meditation retreat."

We want to be smart about this. Ignoring or mismanaging your finances will come back and bite you. So let’s be careful and methodical.

Money still plays an essential part in our life. And unless you are a farmer who can provide everything he needs to survive, you need money.

There’s nothing wrong with buying the things you want. Buy the house, buy the car, buy the phone. But never put it before yourself.

At the same time, I’d argue that we are not creative and brave enough with how we use money to fund the life we want.

But actions mean more than words. I’m not a finance guru. I’ve just experienced different money situations in my life and spent a lot of time thinking and reading about this.

So what I can give you is my honest opinion supported by how I actually live my life, instead of just talking about theories.

Of course, people are different, so be critical and use what fits your own needs and personality. There is no one objectively correct answer when it comes to personal finances, just different philosophies to live by.

Okay, enough disclaimers.

This is how I use money to fund myself:

I think about money as fuel. I need a specific amount to live the life I want without having to worry about it.

What I did several times before and I’m also doing right now is financing my work and life from my savings. That’s something people don’t do enough, even when they could.

Since May 2021, I started writing pretty much full-time and kept only a small half-day-a-week teaching job that partly covers my living costs.

My monthly living costs are $1200. My income from the teaching job is $800. So I’m using about $400 from my savings every month (it’s been 9 months and counting) to keep my TEA focused on writing instead of something else, even though my writing makes no money yet.

It’s an investment. I invest in myself, my skills, and living the life I want now, rather than saving for some potential life I might want to live later.

I use money to support a lifestyle instead of sacrificing my lifestyle to make money. I protect my TEA with money.

Protect your tea

This was the first article in a series about money where I make sense of this big topic and share my thinking process, tactics, and experiences with you.

In the pieces that will follow, I want to stretch our thinking and get on the edge of what we believe about money, and how we can use money to live a better life.

I have a lot more to say about this, but the TEA is limited, so I have to ship it in small bits. :)

Stay tuned for more on Tuesdays and Thursdays.

Share with a friend.

And I’m very much open to your questions and thoughts about this: Let’s talk.