Ondrej Markus

Entrepreneur in ed-tech, building the future of education as a founder and CEO at Playful.

I write about the future of education, designing learning games, and running a startup.

I'm a generalist, introvert, gamer, and optimizing to be useful.

What's your money motivation?

Since I’m writing this series of articles about money, I spend a lot of time thinking about my motivations behind money. And I’ve realized I should share with you my personal preferences because context is important.

My opinions are bound to what I want in life – my needs and values. And if yours are completely different (which is fine, of course), then my methods and attitudes towards money might not be the right fit for you.

So today, I will explain three things that are at the core of how I approach money.

The first thing that will clear up is that money is not just about money. I don’t even mention money there very much. This money series is about exploring the question of:

How to approach money to live a better life?

So it’s not as much about the money itself. It’s about the better life you and I are striving for.

Okay, let’s get into it.

These are my personal preferences that define my relationship with money:

I want to spend my time doing meaningful and enjoyable work.

My goal isn’t the absence of work but a perpetual high-quality work-life. Therefore retirement isn’t something I strive for because I want to keep working as best as I can, as long as I can. To me, good work is not a chore, it’s a delight.

This preference defines my relationship with money the most. I navigate my life with this question in mind at all times:

Do you enjoy what you’re doing these days, and is it meaningful to you?

And if the answer is “no”:

How can you use your resources (including money) to find and do work that is enjoyable and meaningful to you?

As a result, I don’t hesitate to unleash everything I have on solving the problem of rediscovering work and life I enjoy living every day. Which is something I’m doing right now, and I did several times in the past.

I believe this is the best long-term strategy for everyday happiness. Because even though it demands risk-taking and leaps of faith for you, the result is that your life is always enjoyable and meaningful.

Either because you are doing good work now or because you are on your way to (re)finding it. And the exploration process is meaningful in itself and can even be enjoyable if you accept it as inevitable.

As a contrast, imagine an approach where you decide: “Okay, let’s stick with this job I hate for five more years until I get promoted, and things get better.” I mean, it might work out, but who if it does?

I believe that nothing that makes you miserable today is worth sticking with. You are just normalizing suffering in your life and increasing the likelihood that in 5 years, you will tell yourself a different but same story: “In 5 years, things will get better.”

But what if you go for 30 years like that and things never get better? You’ve suffered through your life, counting down days and minutes until your life finally improves. But it never did because you didn’t have the courage to flip the table and go after what you wanted right now.

Okay. Breathe in, breathe out. I got a little passionate and mean in there. It might not be that bad. But I wanted to highlight the worst-case scenario of waiting for things to get better instead of making things better today.

Another “bonus” of this approach is its completeness on any given day. Because I do things I enjoy every day without waiting for “better days,” if a bus runs over me tomorrow, I have no regrets. Life feels more “complete” at the end of every day if you live intentionally.

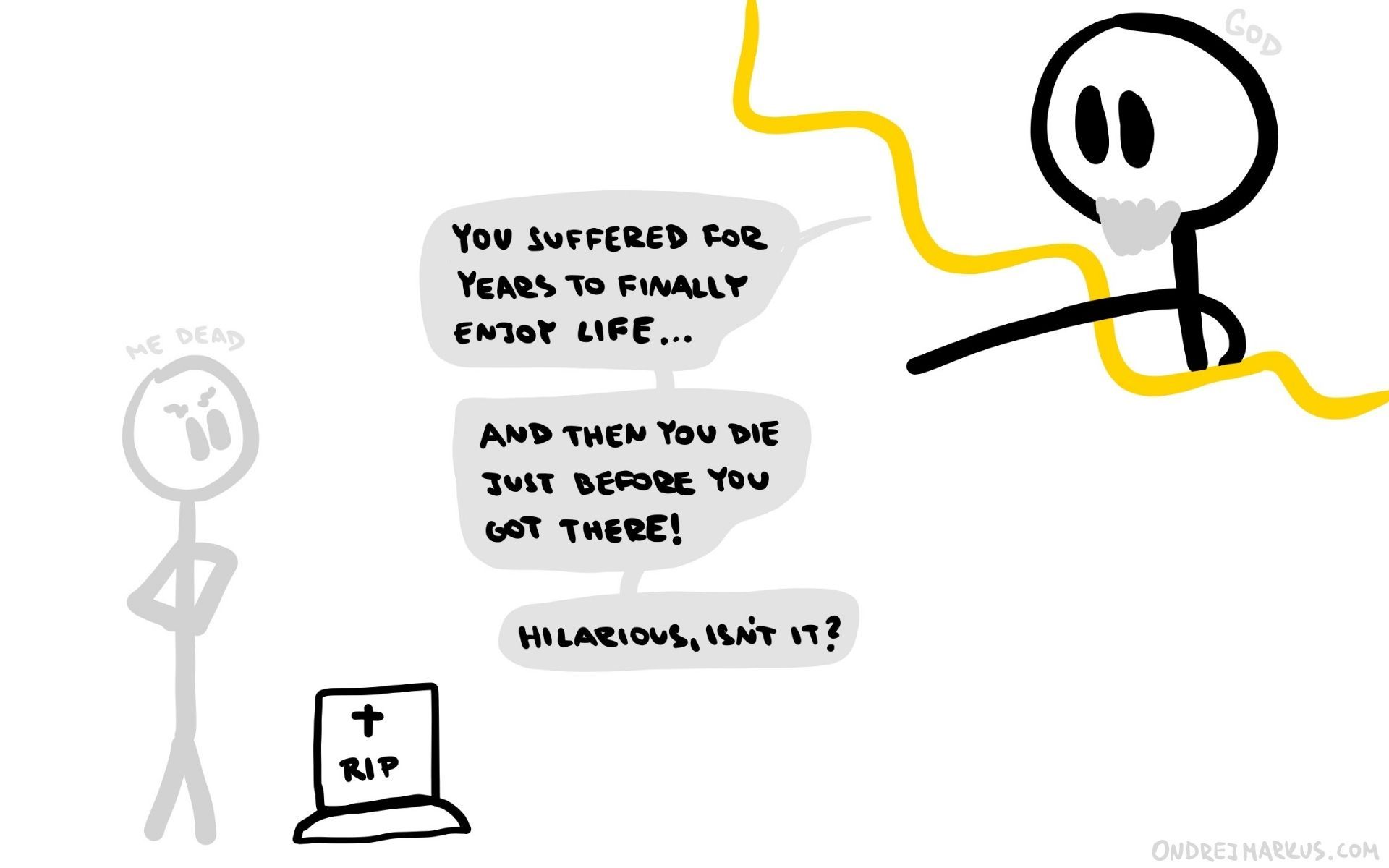

On the other end, if I was grinding while suffering my way to a better life for the last three years, dying before I could enjoy the results feels like a very bad punchline.

No.

To me, going after meaningful and enjoyable work with all I have seems like the most reasonable thing to do. Money feels pointless compared to even a single day spent immersed in doing what you love.

I want to have a family with 2-4 kids someday.

(But I don’t have kids now and will not for at least the next three years.)

Having kids changes the rules of the game. As long as it’s just me, I can go broke, and nobody else is affected. But starting a family makes me responsible for the well-being of other people. And there probably isn’t higher pressure on a human being than that.

So I don’t want to start a family until I have enough money to protect my TEA (time, energy, attention) which would allow me to be a good parent. I don’t want to have kids as a pet project.

Also, having kids costs a lot of money directly (food, clothes, Lego,..) and indirectly (funding your TEA to raise them). So my preference to want kids creates pressure to make more money before I can do it. I don’t like that, but it’s my choice so what can I do? :D

As a partial solution, I would be okay with having kids later in life (40, 50, or even later) if it was the first time I felt it was the right time for it.

It feels better to wait than rushing into something I might not be ready for and then regretting it. There are no backsies with babies.

There are no backsies with babies.

I want to avoid owning too much stuff.

I don’t see myself buying apartments, houses, cars, or anything as expensive anytime soon. Maybe never if possible.

I prefer living lightly without owning too many things to avoid the responsibilities that come with possession. Because I’m lazy and I don’t like taking care of things. If I can have a life unburdened by possession of unnecessary things, I choose that.

I like to have a lot of free space in my life. It enables me to be intentional and proactive instead of passive and reactive. As a result, I can focus fully on the responsibilities I decide are essential to me: like my work and relationships.

Although, I don’t think this one makes a big difference. The principles I describe in other articles will work the same even if you plan on buying many things.

Buying stuff just makes your lifestyle more expensive, which increases the amount of money you need to make to have enough. So it’s just a matter of adjusting numbers in an Excel sheet.

There’s one more resolution connected to this:

I will not leave any financial legacy to my kids after my lights go out.

Two reasons.

- Money tends to spoil people. Family riches rarely seem to be a productive situation for a happy life. The best I can give my kids is how I raise them, not how many millions I can leave behind for them.

- I want to release myself mentally from the non-sense of hoarding riches to pass on to my descendants as if it meant something. It doesn’t, and I reject the pressure society puts on everyone by endorsing this practice. I call BS on that. :)

Okay. That’s it.

Remember, these are just my preferences. I’m not saying this is objectively the best way to live a life. I’m saying this is what I consider the subjectively best way to live my life right now.

I share these so you know where I’m coming from when I talk about money. Because, again, context is important in such a subjective topic as money.

So you can see this and think: “Oh my. This guy is nuts. We have nothing in common. I’m out of there. [ALT+F4]”

I’m eager to discuss. Please question, share, and disagree with me in an email.

See you on Thursday.

Byye.